Missouri’s governor will be calling lawmakers back to the Capitol to lower the state’s income tax rate for all Missourians.

According to a report by Emily Manley of Ozarks First, this comes after the governor rejected a tax rebate plan passed earlier this year by lawmakers. He said he didn’t like that not everyone in the state would benefit.

“There’s nothing wrong with what they were trying to do to get money back to the people of this state, we fundamentally agree with that, we think this is a better plan and we think this is something forever,” Gov. Mike Parson said during a press conference Friday.

Parson said he hopes by Jan. 1, the state’s income rate will be 4.8%. Currently, it’s 5.4%.

“Right now, Missouri is positioned very well to give money back to Missourians,” said Parson. “And I think we all know what we’ve set in place over the last four years. If you let Missourians earn their money, spend their money, they’ll spend their money and the economy will grow,” Parson said.

He also wants to lower the standard deduction.

“The first $16,000 of earned income for single filers and $32,000 for joint filers will be tax-free,” Parson said. “We will better achieve what Missourians were promised through permanent relief.”

Hours before his announcement, he vetoed a plan to give Missourians a $500 non-refundable tax credit based on last year’s filing. It was estimated to cost the state up to $500 million and would be based on last year’s filing.

The legislation said individual filers could get a rebate of up to $500, and married couples could see up to $1,000. However, there was an income cap in place, not allowing any individual who makes more than $150,000 a year or married couples with annual incomes over $300,000 to receive the rebate. Parson’s reason for vetoing the tax rebate was because the General Assembly did not authorize spending the funds out of the correct amount which would violate the constitution.

“Some Missourians would have received somewhere between $100 and $200 while many others would have received nothing,” Parson said.

After the income tax cut, he said the state will still have money left over. His call for a special session also includes reauthorizing tax credits for farmers for six years.

Under the legislation passed by lawmakers this year, the tax credits expire in two years, the governor saying that’s not enough time to get new projects started using the credits. Parson is asking for a six-year sunset provision.

A handful of agriculture groups support the governor’s call for a special session after they were disappointed the tax credit programs were only authorized for two years.

The tax incentives are important to farmers, rural businesses, meat processors, and biodiesel producers and to establish “urban farms.”

The governor said he is still working with lawmakers on a date for the special session. The House chamber is currently under renovation, with the floor stripped down to wood and a new carpet being installed.

According to the Office of Administration, the project is set to be complete at the end of August, a few weeks before the veto session.

White River Marine Group Sees Layoffs at Three Plants, One in Lakes Region

White River Marine Group Sees Layoffs at Three Plants, One in Lakes Region

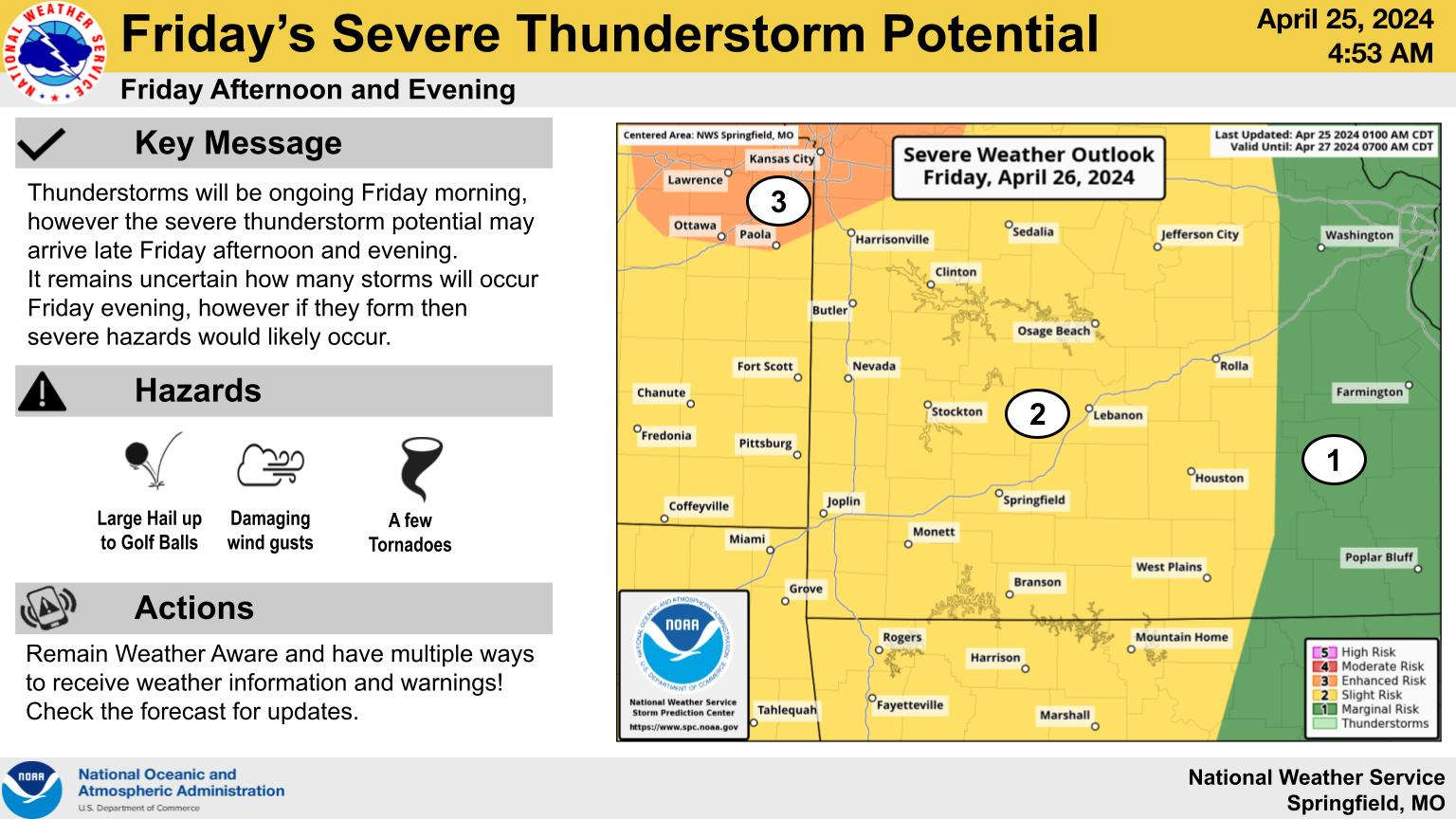

Rainy, Stormy Period Begins

Rainy, Stormy Period Begins

Eureka Springs Police Officer Involved Shooting Ruled Justifiable

Eureka Springs Police Officer Involved Shooting Ruled Justifiable